Immediate Help (248) 826-1172

YES, You Can Get A Mortgage Without Tax Returns

Traditional lenders unfairly penalize entrepreneurs for legally minimizing their taxes — even if your business is thriving. If you're self-employed or 1099, we’ll help you qualify without the outdated tax return roadblocks traditional lenders rely on.

Qualify for the Home You’ve Earned with the Mortgage Designed for Entrepreneurs.

If you’ve been declined because of aggressive write-offs, lack of two years’ tax returns, or needing a jumbo loan with minimal down payment to keep capital in your business—don’t take “no” for an answer. Our Entrepreneur Mortgage Program leverages your real financial strength, not just your taxable income.

Your 3-Step Plan to Homeownership

1. Book a 15-minute strategy call

2. Upload your bank statements or assets

3. Get fully approved in days

Book Your Strategy Call Below!

FEATURES OF OUR ENTREPRENEUR MORTGAGE PROGRAMS

Solutions for those with less than two-year income documentation

Loan amounts up to $4M

Max 90% LTV Purchase

Max 85% LTV R/T Refinance

Max 80% Cash Out Refinance

Minimum 600 FICO

No reserves required ≤ 75% LTV

No 4506T / No K1’s / No P&L’s

No MI

Owner Occupied, Non-Owner Occupied, Second Homes

Self-Employed & 1099 Borrowers

Banks say no. WE says YES!

Schedule your free consultation today!

The Entrepreneur Home Loan: Buy a Home With No Tax Returns or W-2s

Buy a home with no tax returns. Entrepreneurs qualify with up to 90% financing. ...more

Finance

December 03, 2025•4 min read

Entrepreneur Capital Lines of Credit: Unlock Fast, Flexible Access to Your Home Equity

Unlock fast, flexible capital with the Lloyd Lending Team’s Entrepreneur Capital Line of Credit. Access up to 95% of your home equity using bank statements—not tax returns—built specifically for entre... ...more

Finance

November 17, 2025•3 min read

The Complete Entrepreneur Home Loan Guide

This guide has all the information you need to navigate the home buying process with ease.

Frequently Asked Questions

Mortgage Solutions for Self-Employed, Business Owners, and 1099 Earners

Can I get a mortgage if I’m self-employed?

Absolutely — you can get a mortgage if you’re self-employed!

Most traditional lenders struggle to understand how entrepreneurs earn and report income. After all the legal write-offs and business deductions, your tax returns rarely reflect your true financial strength. That’s why we created the Entrepreneur Home Loan — a smarter way for business owners and self-employed professionals to qualify based on the way they actually run their business.

Here’s how we do it:

Bank Statement Loans: We review 12 or 24 months of deposits from your personal or business bank statements to calculate your real income — no tax returns required.

1099 Loans: If you’re an independent contractor or receive 1099 income, we can use your earnings history to qualify you — even without traditional W-2s or tax returns.

P&L Loans: For business owners who keep detailed bookkeeping, we can use a CPA-prepared Profit & Loss statement to verify income instead of relying on tax returns.

Asset Depletion Loans: If you’ve built up savings, investments, or retirement accounts, we can use those assets to calculate repayment ability. This is ideal for entrepreneurs who reinvest profits and prefer flexibility over high taxable income.

Debt Service Coverage Ratio (DSCR) Loans: For investors purchasing or refinancing rental properties, we use the property’s rental income to qualify — not your personal income. If the rent covers the mortgage payment, you may qualify without tax returns or employment income.

At The Lloyd Lending Team, we specialize in helping business owners and self-employed individuals qualify for homeownership with clarity and confidence — even when traditional banks have said no.

How long do I need to be self-employed to get a home loan?

The short answer: you don’t necessarily need two full years of self-employment to qualify for a mortgage — even though most traditional lenders will tell you otherwise.

We focus on your current financial strength, not just how long you’ve been in business. Through the Entrepreneur Home Loan, we can use your business cash flow, bank statements, or verified income sources to help you qualify — even if your business is new or your income varies from month to month.

When traditional banks say no, we say yes.

Can I get a mortgage if I just started my business?

Most banks will tell you that if you haven’t been in business for at least two years, you’re automatically denied. But that’s not the whole story — and it doesn’t have to stop you from buying a home.

Starting a new business can make qualifying for a mortgage feel out of reach, especially if you don’t yet have a long income history or multiple years of tax returns. Through the Entrepreneur Home Loan, we take a more flexible approach that looks at your real financial picture — not just how long you’ve been in business.

Here are a few ways we can help you qualify:

P&L Loans: If you keep up-to-date bookkeeping, we can use a CPA-prepared Profit & Loss statement to verify income instead of relying on tax returns. This approach works even for newer businesses that haven’t filed two full years yet.

Bank Statement Loans: If your business is new but you’ve been making consistent deposits into your personal or business bank accounts, we can use those statements to document income. You don’t need two years of returns — just steady, verifiable cash flow.

Asset Depletion Loans: If your business is still growing but you have savings, investments, or retirement funds, we can use those assets as income to help you qualify. It’s a powerful way to demonstrate financial stability while your business builds momentum.

At The Lloyd Lending Team, we understand that every successful business starts somewhere — and your path to homeownership shouldn’t have to wait.

Can I buy a home without two years of self-employment?

Yes — you can absolutely buy a home even if you’ve been self-employed for less than two years. Most banks will tell you that you need at least two full years of tax returns before you can qualify, but that’s not always true.

At The Lloyd Lending Team, we focus on your true financial picture — not just how long you’ve been in business. If you’ve been making consistent deposits into your personal or business bank accounts, we can use those to verify income through our Entrepreneur Home Loan. This allows you to qualify based on actual cash flow instead of relying solely on tax returns.

We can also use a CPA-prepared Profit & Loss statement or 1099 income only to document earnings when it better represents how you’re paid. And for clients with strong savings, investments, or retirement funds, we can calculate an income equivalent using your assets — helping you qualify based on financial strength rather than business age.

Even without two full years of self-employment, your prior work experience or industry background can still support your application. The key is working with a team that understands entrepreneurship and knows how to tell your financial story the right way — and that’s exactly what we do.

What income do mortgage lenders look at for self-employed borrowers?

When you’re self-employed, most banks focus only on your taxable income — which can look much lower after deductions and write-offs. That’s why many entrepreneurs are told they don’t qualify, even though their real income is much stronger.

At The Lloyd Lending Team, we take a broader approach through the Entrepreneur Home Loan. Instead of relying solely on tax returns, we look at your true financial picture — deposits, income documentation, and assets — to help you qualify based on how you actually earn.

Here’s how we do it:

Bank Statement Loans: We review 12–24 months of deposits from your personal or business bank accounts to calculate your real income — no tax returns required.

P&L Loans: We can use a CPA-prepared Profit & Loss statement to verify income for business owners who maintain accurate bookkeeping.

1099 Loans: If you’re a contractor or receive 1099 income, we can qualify you using your earnings history — no W-2s needed.

Asset Depletion Loans: If you’ve built up savings, investments, or retirement funds, we can use those assets to calculate an income equivalent and help you qualify.

We look beyond what’s on paper to understand your full financial story — helping business owners and self-employed professionals qualify for homeownership based on their true earning power.

What proof of income do I need to show to get a mortgage as an entrepreneur?

As an entrepreneur, you might not have W-2s or consistent pay stubs — but you can still qualify for a mortgage. We use alternative documentation to verify your income based on how you actually earn.

Here’s what we typically review:

Bank Statements: We review 12–24 months of deposits from your personal or business bank accounts to calculate your average monthly income — no tax returns required.

Profit & Loss (P&L) Statements: For business owners with detailed bookkeeping, we can use a CPA-prepared P&L statement to document income instead of traditional W-2s or tax returns.

Asset Depletion Loans: If you have savings, investments, or retirement funds, we can use those assets as income to help you qualify — perfect for entrepreneurs who keep taxable income low.

Debt Service Coverage Ratio (DSCR) Loans: For investors purchasing or refinancing rental properties, we can qualify based on the property’s rental income instead of your personal income. If the rent covers the mortgage payment, you can often qualify without traditional documentation.

Whether your income comes from your business, contracts, or investments, The Lloyd Lending Team specializes in helping entrepreneurs prove their true financial strength — without needing traditional employment paperwork.

What documents do I need to qualify for a mortgage as an entrepreneur?

When you’re self-employed, getting a mortgage isn’t about fitting into a box — it’s about showing your real income story. We take a flexible approach that looks at how you actually earn, making it simple for entrepreneurs to qualify without all the traditional hurdles.

Here’s what we typically review:

Bank Statements: We typically look at 12–24 months of personal or business bank statements to verify your income and cash flow — especially if your tax returns don’t fully reflect what you actually earn.

1099 Forms: If you’re an independent contractor or freelancer, we’ll use one to two years of your 1099 forms, along with your bank statements, to get a clear picture of your income history.

Profit & Loss (P&L) Statement: For business owners with accurate bookkeeping, we can use a CPA-prepared P&L statement covering one to two years to document income instead of tax returns.

Asset Documentation: If you have savings, investments, or retirement accounts, we’ll review those to determine if you qualify for an Asset Depletion Loan — a great option for entrepreneurs who keep taxable income low.

Every entrepreneur’s situation is different, and that’s why we take the time to understand yours. By focusing on documentation that tells the full story of your income, we make the path to homeownership clear and achievable.

Do I need a CPA letter for a self-employed mortgage?

In most cases, you don’t need a CPA letter to qualify for a self-employed mortgage. While some traditional lenders may require one to verify your business income or explain details in your tax returns, most of our Entrepreneur Home Loan programs don’t.

We focus instead on clear, verifiable documentation like bank statements, P&L statements, or assets to demonstrate financial strength. A CPA letter can be helpful in certain cases — such as confirming your business expense ratio — but it’s rarely required to qualify.

What are Bank Statement Loans for entrepreneurs?

Bank Statement Loans are one of the best mortgage options for entrepreneurs who have strong income but struggle to qualify through traditional methods. Instead of relying on tax returns — which often show lower income after deductions — we use the deposits in your personal or business bank accounts to verify what you actually earn.

We typically review 12 to 24 months of bank statements to assess your cash flow and consistency of deposits. This approach is ideal for self-employed professionals, contractors, and small business owners whose income fluctuates from month to month.

By qualifying based on real deposits instead of taxable income, Bank Statement Loans give entrepreneurs a fair and accurate way to show their financial strength.

We understand the nuances of these programs and can guide you through the process from start to finish — helping you qualify for the mortgage you deserve with confidence and clarity.

Can I use my 1099 to get approved for a house?

Yes — you can absolutely use your 1099 income to qualify for a mortgage. The key is understanding how that income is evaluated.

As a 1099 contractor, your income may fluctuate and include business deductions that lower your taxable income. Traditional lenders rely heavily on tax returns, which can make qualifying difficult for self-employed professionals.

We take a different approach. Through the Entrepreneur Home Loan, we can use your 1099 forms as proof of income — and in many cases, qualify you using your 1099s only. We may also review 12–24 months of bank statements to verify consistent deposits and show a complete picture of your true earning power.

When traditional banks say no to 1099 income, we say yes. Our process is built to help entrepreneurs, contractors, and commission-based professionals qualify based on how they actually earn — not just what’s on a tax return.

Can I use my business income to qualify for a mortgage?

Yes — you can use your business income to qualify for a mortgage. The key is how that income is documented.

We understand that many business owners reduce their taxable income through legitimate deductions, which can make it harder to qualify with a traditional lender. That’s why we offer flexible ways to verify your business income without relying solely on tax returns.

Here are a few ways we can help:

Bank Statement Loans: If your business deposits are consistent, we can use 12–24 months of your personal or business bank statements as proof of income. This approach gives us a clear view of your cash flow and allows you to qualify based on your actual deposits.

Profit & Loss (P&L) Statements: If your business is newer or you don’t have multiple years of tax returns, a CPA-prepared P&L statement can be used to document income and demonstrate your company’s financial performance.

Our goal is simple — to help business owners qualify based on the real income that flows through their business, not just what appears on their tax returns.

What is an Asset Depletion mortgage?

An Asset Depletion Mortgage is a loan option that allows business owners and self-employed individuals to qualify for a mortgage using their liquid assets instead of traditional income. It’s ideal for entrepreneurs who have strong savings, investments, or retirement accounts but don’t show consistent income on paper due to business write-offs or fluctuating revenue.

Here’s how it works:

We calculate a monthly income amount based on your total assets. For example, if you have a substantial investment or retirement account, we divide the value of those assets over a set period — typically 10 years — to create an “income equivalent” that can be used for mortgage qualification.

This approach helps entrepreneurs who don’t meet standard income verification requirements but clearly have the financial means to repay a loan. We use Asset Depletion Loans to help business owners leverage the wealth they’ve built to qualify for the homes they deserve — without being penalized for smart tax planning or inconsistent income.

Can I qualify for a mortgage using only my assets?

Yes — you can qualify for a mortgage using only your assets. While traditional lenders focus on taxable income, our Asset Depletion Loans allow you to use liquid assets — such as savings, investments, or retirement accounts — to qualify.

We calculate a monthly income amount based on the value of your assets, so you don’t have to rely on tax returns or traditional employment income. If you’ve built wealth through savings, investments, or the sale of a business, we can help you leverage those assets to purchase the home you’ve worked hard for.

What are the best home loans for self-employed borrowers in 2025?

In 2025, self-employed borrowers have more options than ever. Through the Entrepreneur Home Loan, we offer flexible programs designed to reflect your true financial strength — not just what shows on a tax return.

Bank Statement Loans: Qualify using 12–24 months of deposits from your business or personal accounts — ideal for fluctuating income or large write-offs.

Profit & Loss (P&L) Loans: Use a CPA-prepared P&L statement covering one to two years to verify income without tax returns.

1099 Loans: Perfect for contractors, freelancers, and commission-based professionals — qualify using 1099 income only.

Asset Depletion Loans: Use savings, investments, or retirement funds as income to qualify without relying on tax returns.

Debt Service Coverage Ratio (DSCR) Loans: For investors purchasing or refinancing rental properties, qualify based on the property’s rental income instead of your own.

The best loan for you depends on your goals and how you earn — but one thing is certain: when traditional banks say no, we say yes.

What mortgage options are available for business owners?

As a business owner, you have several mortgage options designed specifically for the way you earn. At The Lloyd Lending Team, we focus on flexible financing solutions that make it easier to qualify — even if your tax returns don’t fully reflect your income.

Here are the most common options available:

Bank Statement Loans: Perfect for business owners with fluctuating income or large write-offs. We use 12–24 months of personal or business bank statements to verify deposits and calculate your true income — no tax returns required.

Profit & Loss (P&L) Loans: If you maintain accurate bookkeeping, a CPA-prepared P&L statement covering one to two years can be used to verify income instead of tax returns.

Asset Depletion Loans: If you have savings, investments, or retirement funds, we can use those assets to calculate a monthly income equivalent — allowing you to qualify based on overall financial strength.

Debt Service Coverage Ratio (DSCR) Loans: For investors purchasing or refinancing rental properties, we can use the property’s rental income to qualify rather than your personal income.

As a business owner, your finances don’t fit into a traditional mold — and that’s exactly why our Entrepreneur Home Loan programs exist. We help you qualify based on your true financial picture, not just what’s on paper.

What mortgage options do I have if I’m self-employed with no tax returns?

If you’re self-employed and don’t have tax returns, you still have several ways to qualify for a mortgage. Most traditional lenders rely solely on tax returns, but we understand that entrepreneurs often have unique financial situations that don’t fit that mold.

Here are some flexible options available through the Entrepreneur Home Loan:

Bank Statement Loans: If you have consistent deposits into your personal or business bank accounts, we can use those statements to verify income instead of tax returns. This option is ideal for business owners with fluctuating income or large deductions.

Asset Depletion Loans: If you have strong savings, investments, or retirement funds, we can use those assets to calculate an income equivalent — allowing you to qualify based on financial strength, not taxable income.

Debt Service Coverage Ratio (DSCR) Loans: For real-estate investors, we can use the rental income from your investment property to help you qualify — without requiring personal tax documentation.

We specialize in helping self-employed borrowers qualify with clarity and confidence, even when tax returns aren’t available. We focus on your real financial story — your income, assets, and cash flow — to help you secure the home you deserve.

When traditional banks say no, we say yes.

Can I get a mortgage without tax returns?

Yes — you can get a mortgage without tax returns. Traditional banks often rely solely on them to verify income, but we understand that for many self-employed borrowers, tax returns don’t tell the full story.

Through the Entrepreneur Home Loan, we offer flexible solutions that allow you to qualify using alternative documentation — no tax returns required.

Here are a few common ways we help:

Bank Statement Loans: Use 12–24 months of deposits from your personal or business bank accounts to verify income.

Profit & Loss (P&L) Loans: Qualify using a CPA-prepared P&L statement to reflect your business income accurately.

1099 Loans: Use your 1099 income only, without the need for W-2s or tax returns.

Asset Depletion Loans: Qualify using your savings, investments, or retirement accounts as income instead of tax documents.

We focus on your actual financial strength — your cash flow, deposits, and assets — to help you qualify with confidence.

When traditional lenders say no, we say yes.

Can I refinance my mortgage if I’m self-employed?

Yes — you can refinance your mortgage even if you’re self-employed. The process works similarly to a traditional refinance, but instead of relying only on tax returns, we verify your income using flexible documentation that reflects how you actually earn.

With the Entrepreneur Home Loan, you can qualify for:

Bank Statement Refinance: We review 12–24 months of deposits from your personal or business accounts to confirm consistent cash flow.

P&L Refinance: A CPA-prepared Profit & Loss statement can be used to show business performance in place of tax returns.

Asset Depletion Refinance: If you have savings, investments, or retirement funds, we can use those assets as income to help you qualify.

Whether you’re lowering your rate, shortening your term, or pulling cash out for business growth, we’ll structure your refinance around your real financial picture — not what’s on your tax return.

Can I get a cash-out refinance if I’m self-employed?

Yes — you can absolutely get a cash-out refinance as a self-employed borrower. Many entrepreneurs use the equity in their homes to fund business expansion, consolidate debt, or invest in new opportunities.

Traditional banks often make this difficult because they rely heavily on tax returns that don’t show your true income after deductions. With the Entrepreneur Home Loan, we take a more flexible approach to help you qualify.

Here’s how we can structure it:

Bank Statement Cash-Out: We use 12–24 months of business or personal deposits to calculate your real income and determine eligibility.

P&L Cash-Out: If you maintain accurate bookkeeping, we can qualify you using a CPA-prepared Profit & Loss statement instead of tax returns.

Asset Depletion Cash-Out: If you’ve built up savings or investments, we can use those assets as income to help you access your equity.

You’ve worked hard to build both your business and your home’s value — we help you tap into that equity confidently, without the limitations of traditional income documentation.

Can I get pre-approved without tax returns?

Yes — you can get pre-approved for a mortgage without tax returns. Most traditional lenders require them, but through the Entrepreneur Home Loan, we use alternative documentation that reflects how you actually earn.

We can pre-approve you using:

Bank Statements: 12–24 months of deposits from your personal or business accounts to show consistent cash flow.

1099 Forms: Your 1099 income history to verify earnings without traditional W-2s.

Profit & Loss (P&L) Statements: A CPA-prepared P&L for business owners with organized financials.

Pre-approval is quick, simple, and doesn’t require years of tax returns. We help you see exactly what you qualify for — with clarity and confidence — from day one.

What credit score do I need for a self-employed mortgage?

Credit score requirements for self-employed borrowers vary depending on the loan program, but most start around 600–640.

At The Lloyd Lending Team, we look at the full picture — not just your credit score. We consider your income, assets, cash flow, and overall financial stability to determine qualification.

Even if your credit isn’t perfect, programs like Bank Statement Loans and Asset Depletion Loans offer flexible guidelines designed for self-employed borrowers with strong financial profiles.

If you’re not sure where you stand, we can review your credit report and help you identify steps to strengthen your application before you apply.

Can I get a mortgage if my business shows a loss?

Yes — even if your business shows a loss on paper, you can still qualify for a mortgage.

Many entrepreneurs write off legitimate expenses to reduce taxable income, which can make it appear as though the business is less profitable than it really is. Through the Entrepreneur Home Loan, we look beyond tax returns to assess your true earning power.

You can qualify using:

Bank Statements: We analyze 12–24 months of deposits to determine your real cash flow.

P&L Statements: A CPA-prepared Profit & Loss can clearly show your gross revenue and expenses.

Assets: If you have savings or investments, we can use those to demonstrate repayment ability.

A business loss doesn’t mean you can’t buy a home — it just means you need a lender who understands how entrepreneurship really works.

Can I use both personal and business income to qualify?

Yes — you can use both personal and business income to qualify for a mortgage.

We take a comprehensive view of your financial picture to ensure you’re evaluated based on all your income sources. That means we can combine:

Personal Bank Statements showing consistent deposits, and

Business Bank Statements or a CPA-prepared Profit & Loss Statement to document revenue from your company.

This blended approach helps you qualify for a higher loan amount by reflecting your true earning power.

Our goal is simple — to help business owners and self-employed professionals qualify based on their complete financial story, not just one piece of it.

Looking for a mortgage without W-2s, pay stubs, or two years of tax returns? If you're self-employed, a small business owner, or a 1099 contractor, qualifying for a traditional mortgage can be difficult — even if you're financially successful.

We offer flexible mortgage solutions for entrepreneurs, real estate investors, freelancers, and self-employed professionals who need financing based on how they actually earn and manage money.

Why Getting a Mortgage is Harder When You’re Self-Employed

Lenders requiring two years of filed tax returns to qualify

Business deductions reduce reported income and limit loan eligibility

Hard to qualify for jumbo loans without large down payments

Traditional loans don’t work with 1099 or seasonal income

Delays in closing due to lengthy documentation reviews

Assets or real estate holdings aren't considered for income

Types of Alternative Mortgage Programs We Offer to have this underneath:

Bank Statement Mortgage – Qualify using 12 months of personal or business bank deposits (no tax returns required)

Asset-Based Mortgage – Use eligible assets such as stocks, bonds, mutual funds, and retirement accounts to qualify (no employment income required)

DSCR Loan – Qualify for investment property loans using rental income only

1099-Only Mortgage – Use your most recent 1–2 years of 1099s to qualify (ideal for contractors, gig workers, and commission-based earners)

P&L-Only Mortgage – Qualify using a CPA-prepared or licensed-tax-preparer Profit & Loss statement (no tax returns or bank statements required)

No-Doc & Low-Doc Options – Available for well-qualified borrowers seeking simplified documentation paths

Program Highlights

Loan amounts up to $4 million to "$5 million"

10% down payment options with no mortgage insurance

Minimum 600 credit score

No tax returns, W-2s, K-1s, or 4506-Ts required

No reserves required up to 75% LTV

Primary, second homes, and investment properties eligible

Fast-track underwriting and approvals

Ideal for self-employed, freelancers, LLC owners, and real estate investors

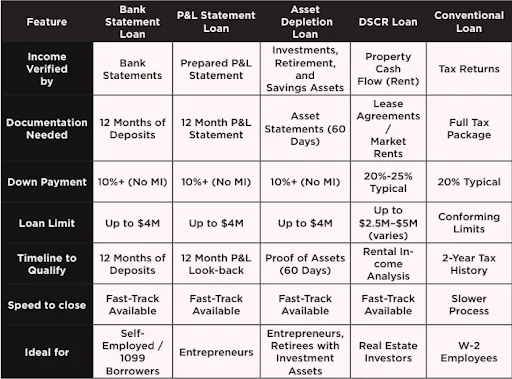

Compare Self-Employed and Traditional Loan Options

Founder – The Lloyd Lending Team | Creator of the

Entrepreneur Home Loan

Maxwell Lloyd is a mortgage strategist and entrepreneur dedicated to helping business owners achieve homeownership without sacrificing the way they run their business. As the founder of the Lloyd Lending Team and creator of the Entrepreneur Home Loan, Max is reshaping how self-employed professionals access financing — by designing a process that finally works for them.

After years of helping clients who were denied by traditional banks, Max saw a clear pattern: successful entrepreneurs with thriving businesses were being told no simply because their income didn’t fit neatly inside the standard mortgage box. That frustration became the fuel for something better.

The Entrepreneur Home Loan was born from Max’s belief that entrepreneurs shouldn’t have to change the way they earn or report income just to qualify for a home. His team built a smarter approval process that looks at real financial strength — not just what shows up on a tax return — giving business owners a path to buy, refinance, or access equity with clarity and confidence.

Known for his strategic approach and clear communication, Max partners with financial advisors, accountants, and real estate professionals to help their clients make more informed decisions about their housing wealth. He also speaks to entrepreneurial and professional groups about how housing can be leveraged as a tool for growth, stability, and freedom.

Max’s mission is simple: to empower innovators, business owners, and wealth-builders with financing that honors their hard work — and gives them the home and future they deserve. Through Entrepreneur Home Loans and the Lloyd Lending Team, he’s redefining what’s possible for self-employed borrowers, one success story at a time.

See What You Qualify For

If you’re self-employed and looking for a mortgage without using tax returns, or you want to explore bank statement or asset-based options, we’re here to help. Fill out the form below to schedule a consultation and qualify in minutes.

Request Your Entrepreneur Mortgage Consultation

Maxwell Lloyd, Mortgage Planner NMLS #2374416

2530 S Rochester Rd, Rochester Hills, MI 48307

Office: (248) 826-1172 | [email protected]

© 2025 Trust Mortgage LLC. Trust Mortgage LLC is a mortgage broker, NMLS#2491461, 2530 S Rochester Rd, Rochester Hills, MI 48307. Loans are arranged through third-party lenders. Equal Housing Lender. This is not a commitment to lend. All loans are subject to credit approval, underwriting guidelines, and program availability. Terms and conditions apply.

NMLS Consumer Access – https://www.nmlsconsumeraccess.org/EntityDetails.aspx/COMPANY/2491461